What is meant by Dividend?

A dividend is a distribution of profits by a company to its

shareholders. It represents a portion of the company's earnings that is paid

out to investors as a reward for owning shares. Dividends are typically paid in

cash but can also be distributed in the form of additional shares of stock or

other property.

1. When We Get Dividend:

Dividends are usually paid periodically, commonly on a

quarterly basis, although some companies may choose to pay them semi-annually

or annually. The payment date, also known as the dividend payout date, is when

shareholders receive the dividend. However, to be eligible to receive the

dividend, an investor must own the stock on the record date, which is set by the

company's board of directors.

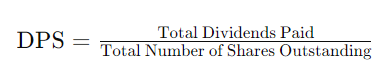

2. Formula for Dividend:

The formula for calculating dividends per share (DPS) is

straightforward:

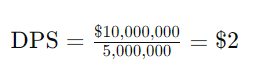

3. Calculation of Dividend:

For example, let's say a company paid total dividends of $10

million and has 5 million shares outstanding. Using the formula:

=$2

So, the dividend per share is $2.

4. Factors Affecting Dividend:

Several factors can influence a company's decision to pay

dividends and the amount of dividends it pays. Some of these factors include:

- Earnings: The company's profitability and earnings are significant determinants of its ability to pay dividends. Companies with stable and growing earnings are more likely to pay dividends consistently.

- Cash Flow: Cash flow is crucial for paying dividends. Even if a company has reported profits, it needs sufficient cash flow to distribute dividends to shareholders.

- Financial Health: The financial health of the company, including its debt levels and liquidity position, can impact its ability to pay dividends. Companies with strong balance sheets are more likely to maintain or increase dividends.

- Industry and Economic Conditions: Industry dynamics and broader economic conditions can influence dividend payments. Companies operating in cyclical industries or facing economic downturns may cut or suspend dividends to conserve cash.

- Investment Opportunities: Companies may retain earnings instead of paying dividends if they have attractive investment opportunities that can generate higher returns for shareholders in the long run.

- Legal and Regulatory Conside rations: Companies are subject to legal and regulatory requirements regarding dividend payments. They must comply with laws, regulations, and corporate governance standards governing dividend distributions.

- Dividend Policy: Each company establishes its dividend policy, which outlines its approach to dividend payments. Some companies have a stable dividend policy, aiming to pay dividends regularly, while others may adopt a variable or no-dividend policy.

Understanding dividends and the factors that influence them

is essential for investors evaluating the investment potential of

dividend-paying stocks. Dividends can provide a source of regular income and

contribute to total returns for shareholders. However, investors should conduct

thorough research and analysis to assess the sustainability and growth

prospects of dividends before making investment decisions.

Dividends represent a portion of a company's earnings that

are distributed to its shareholders. There are several types of dividends:

- Cash Dividends: The most common form, where shareholders receive payments in cash.

- Stock Dividends: Shareholders receive additional shares of the company's stock instead of cash.

- Property Dividends: Shareholders receive assets or property, such as products or real estate, instead of cash.

What is meant by Dividend? when we get, calculation, factors affecting on dividend, types of dividend , various dividend dates, and few terminology's

6. Various Dividend Dates:

- Dividend Declaration Date:

The dividend declaration date is when a company's board of

directors announces its intention to pay a dividend. This announcement includes

the amount of the dividend and the dividend payment date.

- Record Date:

The record date is the cutoff date established by the

company, typically a few days after the declaration date. Shareholders must be

on the company's books as of this date to receive the dividend. Investors who

purchase shares after the record date will not receive the upcoming dividend

payment.

- Ex-Dividend Date:

The ex-dividend date is the date on or after which a stock

trades without the dividend. If you purchase shares on or after this date, you

will not receive the upcoming dividend payment. The ex-dividend date is usually

set one business day before the record date.

- Dividend Payment Date:

The dividend payment date is when the dividend payments are

actually made to shareholders. This date is typically a few weeks after the

record date to allow for processing.

7. Few terminology’s about Dividend

a. Dividend Yield:

The dividend yield is a measure of the dividend's annualized

payout relative to the stock price. It is calculated by dividing the annual

dividend per share by the stock's current price and is expressed as a

percentage. A higher dividend yield indicates a higher return on investment

from dividends.

b. Dividend Payout Ratio:

The dividend payout ratio measures the percentage of

earnings that a company distributes to shareholders in the form of dividends.

It is calculated by dividing the total dividends paid by net income. A lower

payout ratio indicates that a company retains more of its earnings for

reinvestment or other uses, while a higher payout ratio suggests that a company

distributes a larger portion of its earnings to shareholders.

c. Dividend Reinvestment Plan (DRIP):

Some companies offer dividend reinvestment plans (DRIPs),

which allow shareholders to reinvest their dividends to purchase additional

shares of the company's stock, often at a discounted price. DRIPs provide

shareholders with an easy and convenient way to compound their investment

returns over time by reinvesting dividends to acquire more shares.

d. Qualified vs. Non-Qualified Dividends:

Dividends can be classified as either qualified or

non-qualified for tax purposes. Qualified dividends are taxed at a lower rate

than ordinary income, while non-qualified dividends are taxed at the investor's

ordinary income tax rate. To qualify for the lower tax rate, dividends must

meet certain criteria set by the IRS, such as being paid by a U.S. corporation

or a qualified foreign corporation.

e. Dividend Policies:

Each company establishes its dividend policy, which outlines

its approach to dividend payments. Some companies have a stable dividend

policy, aiming to pay dividends regularly and consistently increase them over

time. Others may adopt a variable or no-dividend policy, depending on factors

such as the company's growth prospects, cash flow, and capital allocation

priorities.

Understanding these details about dividends is crucial for

investors seeking to build a dividend income portfolio or evaluating the

investment potential of dividend-paying stocks. Dividends can provide a source

of regular income and contribute to total returns for shareholders, making them

an important aspect of investment strategy and financial planning.