Change in Character in Stock Market

Change in Character

In the stock market, a "change of character"

refers to a significant alteration in the behavior or dynamics of the market or

individual stocks. This change often signifies a shift in underlying trends,

sentiment, or fundamental factors influencing stock prices. Understanding these

changes is crucial for investors and traders as they can indicate potential opportunities

or risks in the market.

Here's a comprehensive breakdown of the concept:

1. Market Behavior:

- Changes in market behavior encompass alterations in trading patterns, volatility levels, and overall price movements.

- Traders and analysts observe shifts in the market's behavior to identify potential changes of character. For example, a market previously characterized by stable, upward movements may exhibit increased volatility or sudden reversals, indicating a potential change in sentiment or underlying market conditions.

2. Investor Sentiment:

- Investor sentiment refers to the collective attitude of market participants towards investing in stocks or the overall market.

- Changes in sentiment can be influenced by a variety of factors, including economic data releases, geopolitical events, or changes in market narratives.

- A change of character often accompanies shifts in sentiment, such as a transition from optimism to pessimism, which can result in significant fluctuations in stock prices as investors reassess their expectations and risk perceptions.

3. Fundamental Factors:

- Fundamental factors are the underlying financial and economic conditions that drive stock prices, including earnings growth, revenue forecasts, industry trends, and regulatory developments.

- A change of character in a stock or sector may occur due to shifts in these fundamental factors. For example, a company experiencing declining sales or profitability may undergo a change of character as investors reevaluate its growth prospects and intrinsic value.

What is Change in Character in Stock Market ?

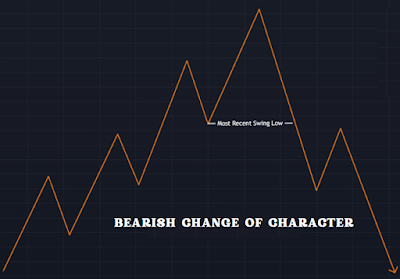

4. Technical Analysis:

- Technical analysis involves studying historical market data, such as price and volume patterns, to forecast future price movements.

- Traders use technical indicators and chart patterns to identify changes of character in the market or individual stocks. For instance, a breakdown of key support levels or the formation of a bearish reversal pattern may signal a change in trend direction.

5. Market Cycles:

- Market cycles refer to the recurring patterns of growth, peak, contraction, and trough that occur in financial markets over time.

- Changes of character often coincide with transitions between different market cycles. For example, a bull market characterized by strong upward momentum may experience a change of character as it approaches a peak and transitions into a period of consolidation or correction.

By closely monitoring market behavior, investor sentiment,

fundamental factors, technical indicators, and market cycles, traders and

investors can better anticipate and respond to changes of character in the

stock market, enabling them to make informed decisions and manage risk

effectively.